You’re driving down the road—until, out of nowhere, you get into a fender bender. Just like that, your car’s value becomes more than just a number. Now, it’s a back-and-forth between you, your insurance company, and whatever weird formula they use to decide how much they’ll pay.

When dealing with car insurance claims, knowing what your car is really worth is super important. Getting accurate car value for insurance claims saves time and money when filing claims. The same is true when negotiating insurance rates, or seeking fair compensation for totaled vehicles.

Many check KBB or NADA car value by VIN, but they don’t consider history, condition, or market trends. Thankfully, VinCheck.info’s Car Value by VIN tool provides precise value and unique car details.

Act now to get an accurate valuation for your car—visit VinCheck.info today!

How Car Value Affects Insurance Claims

1. Determining Payouts for Totaled Vehicles

Many check car values using NADA or KBB, but they don’t consider history, condition, or market trends.

VinCheck.info’s Car Value by VIN tool gives you an accurate car value and details based on your VIN number. This ensures you have an accurate car value for insurance claims before negotiating with the insurer.

Want to know how depreciation plays into this? Read our guide on how depreciation affects your car’s value and see how it impacts insurance payouts.

2. Accurate Premium Calculations

Your insurance cost depends on your car’s value. If you overestimate it, you’ll pay more than you need to. If you underestimate it, you might not get enough coverage.

With a VIN check for insurance, you can ensure that your insurer bases your premium on the correct vehicle value.

3. Claims Settlement Negotiations

If your insurance company lowballs your car’s value, it can cause issues when settling a claim. To challenge their offer, you’ll need proof of what your car is really worth. A detailed report from VinCheck.info can help back up your case with solid evidence.

Not sure how to determine your car’s real value? Read our guide on how to use your VIN to determine car value.

4. Depreciation and Car Value Over Time

Car value drops over time, which means the older your car gets, the less your insurance will pay if you file a claim. This is something to keep in mind when choosing comprehensive or collision coverage.

Knowing how depreciation affects your car insurance claims value can help you decide on the right insurance. VinCheck.info’s car history tool can give you a better idea of your car’s depreciation and help you estimate potential claim payouts.

5. Impact of Modifications on Car Value

If you’ve customized your car—whether it’s a turbo upgrade or a flashy new paint job—these changes can impact its value. But here’s the thing: insurance companies might not recognize those upgrades unless they’re officially listed in your policy.

A VIN check can help confirm if your modifications are accounted for, so your insurer knows exactly what your car is worth when handling claims.

6. The Role of Market Value in Insurance Claims

When you file a claim, insurance companies don’t just take your word for what your car is worth—they compare it to similar models on the market. If you’re not aware of its real value, you might end up with a lower payout than expected.

VinCheck.info’s market value analysis helps you stay on top of your car’s worth, so you’re not caught off guard when dealing with insurance claims.

7. Comprehensive Coverage and Car Value

If you have comprehensive coverage, knowing your car’s value is crucial. In cases of theft, vandalism, or natural disasters, your insurance payout depends on what your car is actually worth—not just what you think it is.

A quick VIN check can give you an accurate market value, making sure your coverage matches your car’s true worth.

8. Insurance Claim for Classic or Rare Cars

Classic and rare cars don’t follow the usual depreciation trends—some even increase in value. That makes it tricky to determine their worth when it comes to insurance claims.

VinCheck.info’s historical data can help you get a more precise valuation, ensuring your unique ride is covered for what it’s really worth.

Why VinCheck.info is Better Than Basic Car Value Tools

Unlike other tools that just give you a rough estimate based on the car’s make, model, and year, VinCheck.info’s Car Value by VIN tool digs deeper for a more accurate number. Here’s why:

- VIN-Specific Info – Focuses on your car’s unique details, including features, history, and any past modifications.

- Market-Based Pricing – Adjusts for real-time trends and demand instead of using outdated estimates.

Learn the difference between NADA and Kelley Blue Book to see which one suits your needs.

- Detailed Reports – Goes beyond basic values, covering accident history, title status, past owners, and even car insurance claims value.

- Custom Search Filters – Lets you refine results to focus on things like damage, repairs, or ownership history.

- Real-Time Data – Uses the latest market info for more accurate pricing.

- Better Accuracy – Factors in condition, location, and regional pricing differences for a more precise estimate.

- Fraud Detection – Spots potential issues like odometer rollbacks, title fraud, or tampering.

- Pro-Level Insights – Provides reports similar to what dealerships and insurance companies use. This makes it a valuable tool for a VIN check for insurance purposes.

- Saves Time & Money – Get all the key details instantly, no need for extra evaluations or appraisals.

- Instant Vehicle History – Quickly check a car’s past before buying, so there are no surprises.

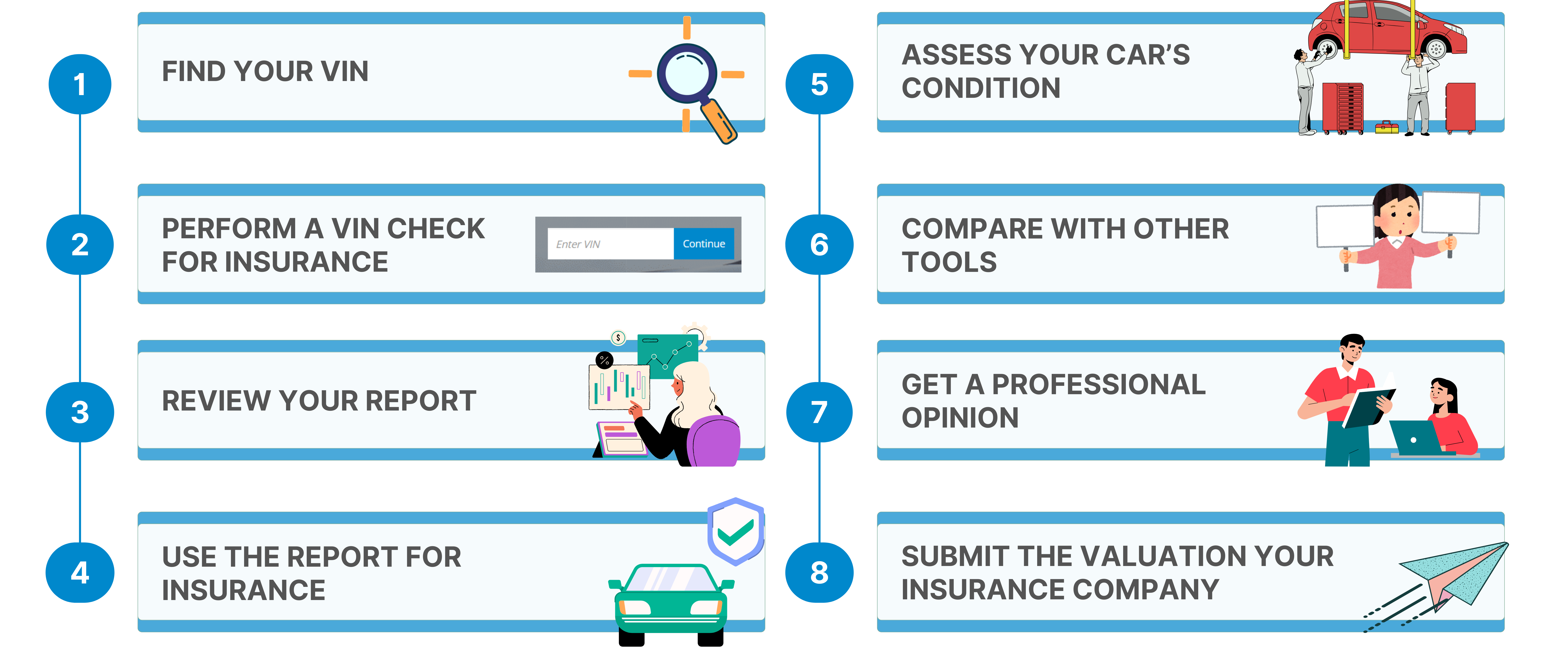

Steps to Check Your Car’s Value for Insurance Claims

1. Find Your VIN – Look for it on the dashboard, driver’s side door frame, or in your car’s documents.

2. Perform a VIN Check for Insurance – Enter your VIN to get an instant valuation.

3. Review Your Report – Check details like depreciation and market trends to understand your car insurance claims value.

4. Use It for Insurance – Show the report to your insurer when filing a claim or adjusting premiums.

5. Assess Your Car’s Condition – Make sure the valuation matches your car’s mileage, exterior, and interior condition.

6. Compare with Other Tools – Cross-check with sites like Car and Driver or Edmunds for accuracy.

7. Get a Professional Opinion – If needed, consult a car appraisal expert or insurance adjuster.

8. Submit to Your Insurer – Once verified, send the valuation to your insurance company for claims or coverage updates.

Take Control of Your Car Insurance Claims with VinCheck.info

Don’t let outdated estimates cost you money! Use VinCheck.info to get an accurate, fair, and well-documented value for your car.

Check your car value now to protect your investment and make smart insurance decisions.