Free Texas License Plate Lookup – Get Instant Vehicle Info

Check Vehicle History with 100% Free Texas License Plate Lookup – Fast & Easy!

Check Vehicle History by Texas Plate Number – No VIN Needed

Looking to uncover a car’s history in Texas using only the license plate number? Our Texas License Plate Lookup tool gives you instant access to key vehicle details—for free. It’s a fast and reliable way to verify a vehicle before buying or selling in the Lone Star State.

Whether you’re using a license plate lookup Texas tool through the DMV or checking private listings, this guide shows you how to uncover red flags and avoid getting stuck with a lemon.

Texas License Plate Lookup: Guaranteed Money Saver!

Texas is home to over 29 million registered vehicles, making it one of the largest vehicle markets in the U.S. That also means more chances for fraud and hidden issues. Common risks in Texas include:

- Title washing – Covers up flood or salvage history (especially common after major storms and floods)

- VIN cloning – Stolen cars are sold with fake identities, often across state lines

- Odometer fraud – Tens of thousands of vehicles in Texas show mileage discrepancies each year

A quick Texas license plate search can reveal a vehicle’s real history, accident reports, recalls, liens, and more—no VIN required. It’s one of the easiest ways to protect your investment.

Why Use a Texas License Plate Lookup?

A Texas plate check is one of the best ways to verify a vehicle’s background when shopping for used cars. Whether you’re scanning Craigslist, Facebook Marketplace, or dealership lots, a Texas tag lookup can provide essential vehicle insights.

1. Avoid Common Used Car Scams

Texas ranks high in title fraud and vehicle theft. In 2023, over 124,000 vehicles were stolen statewide. Many scam cases involve:

- Title washing (hiding salvage/flood titles)

- Odometer rollback to inflate value

- Selling flood-damaged vehicles as clean

Using a Texas license plate lookup free tool can help expose these tactics before they cost you.

2. Get Instant Access to Vehicle History

A quick plate search gives you a snapshot of the vehicle’s past:

- Accidents

- Mileage logs

- Recalls

- Ownership history

All without needing a VIN!

3. Confirm Lien Status

Don’t get stuck with someone else’s loan. A lookup checks if the car:

- Has unpaid loans or liens

- Is stolen or listed in police records

4. Know the Car’s Real Value

The report includes estimated market value, so you can:

- Avoid overpaying

- Negotiate better

- Spot inconsistencies between condition and price

5. It’s Fast, Easy, and Often Free

A free Texas license plate lookup takes less than a minute—and costs nothing.

What You’ll Find with Our Free TX License Plate Lookup

Our TX plate lookup report pulls data from trusted national and state databases. Here’s what your search includes:

|

✅ Vehicle Specs Get make, model, trim, engine type, transmission, and body style. |

|

|---|---|

|

✅ Title History Instantly see if the title has been branded as salvage, rebuilt, junk, or more. |

|

|

✅ Accident & Damage Records From fender benders to total loss records, uncover any reported incidents. |

|

|

✅ Odometer Rollback Detection Spot suspicious mileage changes that may point to odometer fraud. |

|

|

✅ Recalls & Manufacturer Defects NHTSA-sourced data lets you check if critical recalls have gone unresolved. |

|

|

✅ Theft Reports Know if the car was ever reported stolen or recovered by law enforcement. |

|

|

✅ Market Value Estimates Get pricing insights to help you negotiate or set a fair resale price. |

|

|

✅ Lien & Repossession Data Avoid surprises by confirming if the vehicle has any outstanding loans. |

|

|

✅ Vehicle Use Type Determine if it was a personal vehicle, rental, fleet, or commercial. |

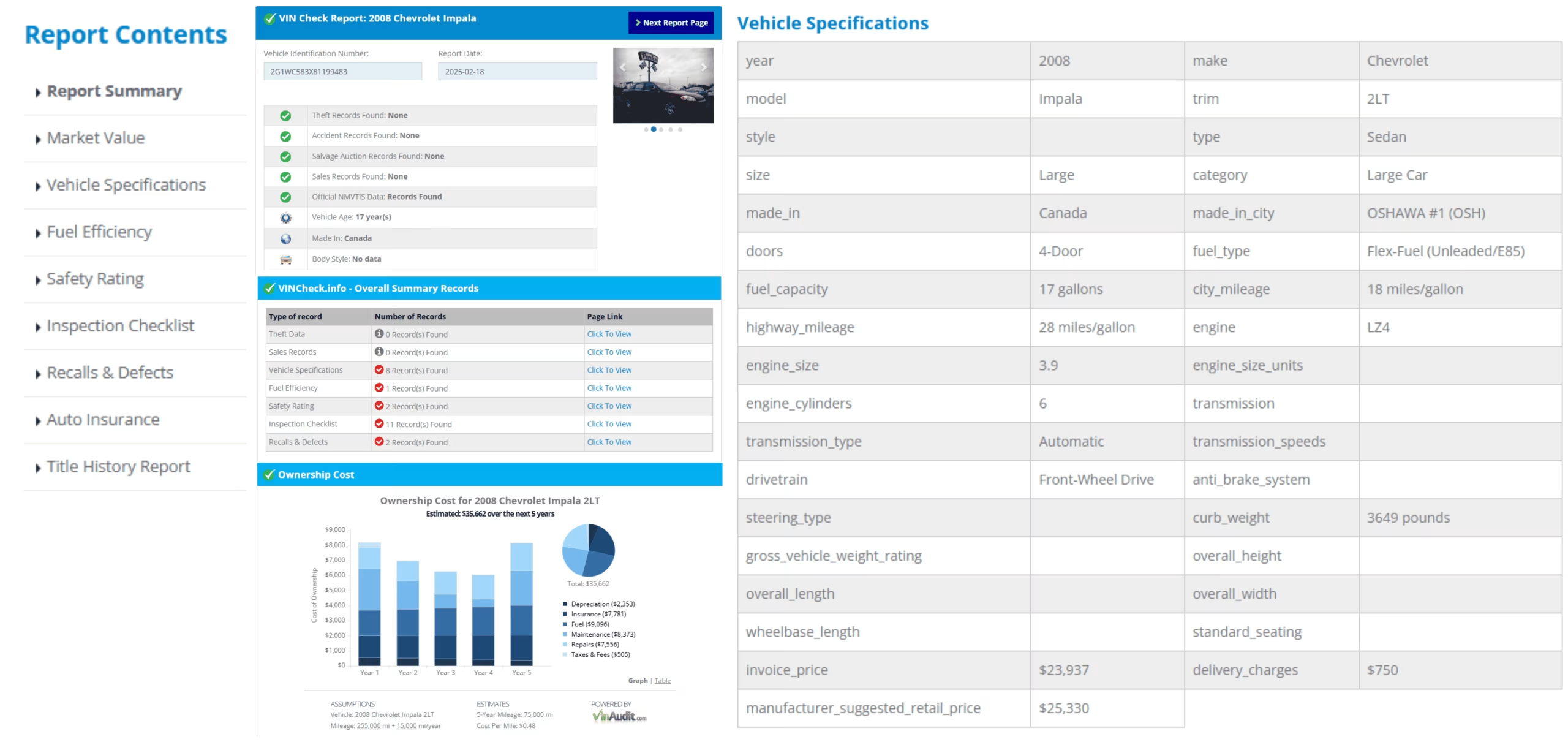

Sample Vehicle History Report

How to Run a Free Texas Plate Lookup

Check a vehicle in less than a minute:

- Enter the Texas license plate number (e.g., ABC-1234)

- Select “Texas” from the dropdown menu of U.S. states

- Click “Search” to generate your free vehicle history report

Whether you need a Texas license plate lookup owner search or you’re just curious about a vehicle’s past, this tool is your best bet.

Texas License Plate Types & Formats

Becoming familiar with Texas vehicle plate formats can help you verify vehicles more confidently. Here’s a quick breakdown:

Becoming familiar with Texas vehicle plate formats can help you verify vehicles more confidently. Here’s a quick breakdown:

- Standard Plates: Follows the classic ABC-1234 format. Most commonly issued in Texas.

- Specialty Plates: Custom and themed plates ordered via MyPlates.com. Includes sports teams, charities, etc.

- Digital Plates: Approved for limited commercial and fleet use. Features real-time tracking and registration updates.

- Temporary Tags: Issued after purchase or transfer. Use extra caution when checking these.

Legal & Ethical Considerations for License Plate Lookups in Texas

✅ What You Can Legally Do with a Texas License Plate Lookup

A license plate lookup Texas tool is legal if used for legitimate, non-invasive purposes like:

- Check vehicle title and registration status

- Review reported accidents and damage history

- Identify recall notices from the manufacturer

- Confirm vehicle specifications (engine, trim, model)

- See theft or salvage records linked to the plate

These checks are fully compliant with the Driver’s Privacy Protection Act (DPPA) and Texas regulations.

🚫 What You Can’t Do

Not everything is fair game. Texas law protects personal privacy, especially when it comes to vehicle ownership. The following actions are strictly prohibited:

- Accessing the current owner’s name, address, or contact details

- Using lookup tools for stalking, harassment, or solicitation

- Sharing private data obtained through unauthorized methods

Need to Contact a Vehicle Owner?

If you have a legitimate reason—like a legal claim or a towing situation—you can file Form VTR-275 through the Texas Department of Motor Vehicles (TxDMV). You’ll need to:

- Provide a valid reason

- Include documentation supporting your request

- Pay a small processing fee

Benefits of Using VinCheck.info for Texas Vehicle History

Why choose VinCheck.info for your Texas plate lookup?

- ✅ 100% Free – No hidden fees or subscriptions

- ✅ Data from trusted sources – NMVTIS, NHTSA, NICB, lenders & more

- ✅ Covers Texas and U.S. records

- ✅ Mobile-friendly and anonymous

👉 Start Your Free Texas License Plate Lookup Now!

Is the Texas license plate lookup tool really free to use?

Can I find out who owns a car with a Texas license plate?

No, personal information is protected by law. Under the Driver’s Privacy Protection Act (DPPA), private owner data isn’t publicly available.To request ownership details, you must submit a formal request through the Texas Department of Motor Vehicles (TxDMV) and meet their legal criteria. You can still check important public records like accident history, title status, and past registration details using our free tool.

How accurate is the information from a Texas license plate search?

Very accurate — sourced from official databases. We use verified government and industry sources such as:

- NMVTIS – National Motor Vehicle Title Information System

- NHTSA – National Highway Traffic Safety Administration

- State-level DMV records (when available)

These ensure up-to-date and reliable insights, giving you confidence when buying, selling, or checking a used vehicle in Texas.

Should I run a Texas license plate check before buying a used car?

Yes — it’s a smart move for any Texas car buyer. Running a free Texas license plate check helps you:

- Spot title issues (salvage, rebuilt, flood)

- Uncover hidden accident or damage history

- Verify odometer readings and vehicle specifications

- Check for active recalls or liens

Don’t rely on a seller’s word alone — run a check and protect your investment.

Can I run a license plate lookup for vehicles registered outside Texas?

Yes, in many cases. While this tool is optimized for Texas license plates, you can also search plates from other U.S. states, depending on data availability. Results may vary by state but can still include:

- Title status (clean, salvage, rebuilt)

- Reported accidents and recall data

- Basic vehicle details (make, model, year, specs)

If you’re not sure, just enter the plate number and select the correct state — it’s free to try.

How long does it take to get results?

Just a few seconds. Once you enter a plate number and state, the system pulls data in real time. There’s no waiting period, no email confirmation, and no upsell for basic results.

⏳ Total time:

- Input: ~15 seconds

- Lookup results: Instant

- Total cost: $0

Fast, free, and hassle-free — perfect for quick research before you commit to a deal.

What kind of vehicle information will I see in the report?

Our free Texas license plate lookup provides essential public vehicle records, including:

- Vehicle specifications (make, model, trim, engine)

- Title brands (salvage, flood, rebuilt)

- Open recalls and safety issues

- Odometer reading discrepancies

- Theft check and lien status

- Registration history (if available)

This information helps you make informed decisions and avoid scams when buying or selling a car.