Free Utah License Plate Lookup – Get Free Vehicle History

Considering a used car in Utah? Perform a 100% FREE Utah License Plate Lookup to instantly access the vehicle’s full history. Simply enter the plate number and get a detailed report — including title status, accident records, odometer rollbacks, open recalls, liens, theft checks, and more.

Why Trust VinCheck.info for Utah Plate Lookups?

✅ Completely Free – no hidden charges, subscriptions, or credit cards required

✅ Reliable Data – powered by NMVTIS and industry-leading partners

✅ Instant Reports – mobile-friendly, no apps or downloads needed

✅ Confidential & Secure – no sign-up required, search anonymously

Why Run a Utah License Plate Lookup?

Utah’s roads stretch from the scenic red rock deserts of Moab to the snowy peaks of Salt Lake City and Park City. With over 2 million registered vehicles, the state has a thriving used car market — but not every car is problem-free.

The Utah Division of Motor Vehicles (DMV) oversees vehicle titles and registrations, all tied to license plate numbers. Running a free plate check helps you uncover important details about a car’s past — including accident damage, title issues, odometer fraud, and outstanding liens.

Don’t take chances when buying a used vehicle. Run a FREE Utah Plate Lookup today to make sure your next car is safe, reliable, and free from hidden problems.

Utah Plate Serial Format:

A12 3BC / 1ABC2

Why Use a Free Utah License Plate Lookup?

Planning to buy or sell a used car in Utah? A 100% free Utah license plate lookup from VinCheck.info makes it easy to uncover key details about any vehicle before you commit. Just enter a Utah plate number and instantly access:

- Vehicle Specs – Year, make, model, trim, and body configuration.

- Title History – Spot branded titles such as salvage, rebuilt, flood, or junk—even if issued outside Utah.

- Accident Records – Learn about reported crashes, structural damage, or airbag deployments.

- Mileage Readings – Detect odometer rollbacks or unusual mileage inconsistencies.

- Market Value – Estimate the vehicle’s fair market price based on history and condition.

- Liens & Loans – Check for unpaid liens, repossessions, or financing issues.

- Ownership Type – Find out if the car was privately owned, leased, or used for fleet/rental.

- Open Recalls – See if manufacturer safety recalls are still unresolved.

- Theft Records – Verify if the vehicle was ever reported stolen or recovered.

- Sales & Title Transfers – Review ownership changes and interstate transfer records.

Whether you’re browsing used cars in Salt Lake City, Provo, Ogden, St. George, or Logan, a free Utah tag lookup gives you the confidence to make a safer decision—with no hidden fees, no subscriptions, and no account required.

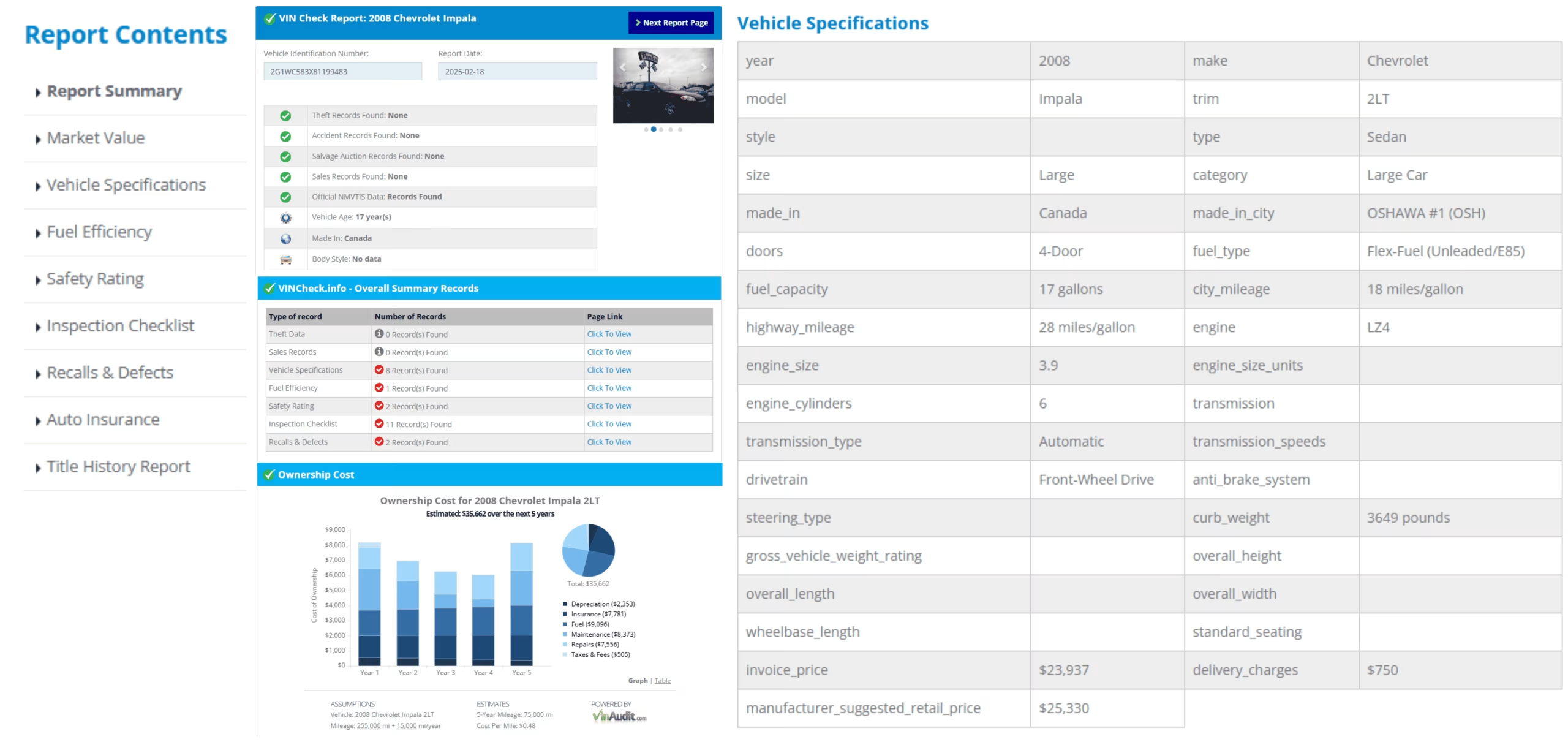

Sample Vehicle History Report

Utah Vehicle Registration & Renewal

1. New to Utah? (60 Days Rule)

- You must register your vehicle within 60 days of moving.

- Bring your title, most recent registration, VIN inspection (Form TC-661), and any inspection reports (emissions/safety if required).

2. Registering or Transferring Ownership

- Gather: title (or bill of sale), proof of purchase price, and ID.

- Pay sales tax + registration/title fees (check the [Fee Estimator] on Utah DMV site).

- If needed, get a temporary 30-day permit ($6) while waiting for inspections.

3. Renewal Options (Pick What Works for You)

- Online (fastest): Use VIN + PIN (or last name, ZIP, plate, last 8 VIN).

- On the SPOT: At authorized inspection stations.

- DMV Service Centers: Some require appointments (Ogden, Provo, Taylorsville, etc.).

- Automatic Renewal: Enroll via Motor Vehicle Portal (MVP).

4. Common FAQs in 30 Seconds

- Didn’t get a notice? Check renewal info with your plate + VIN on the MVP.

- Lost plate/registration? Order replacements on MVP.

- Address change? Update online or call DMV.

- Emissions rule of thumb: Even model years = test in even years; odd = odd years.

- Family sale? Sales tax still applies.

5. Handy Links & Numbers

- Utah Motor Vehicle Portal (MVP): Do most tasks online.

- DMV phone: 801-297-7780 or 1-800-DMV-UTAH.

✅ Pro Tip: Save time—use the MVP online system whenever possible to skip lines.

Utah Vehicle Title Requirements

Know if Your Vehicle Needs a Title

- Cars, motorcycles, trailers, semi-trailers, manufactured homes → All must be titled (except non-commercial trailers ≤ 750 lbs).

- Off-Highway Vehicles (OHV) → 1988+ must be titled; 1987 or older optional.

- Watercraft → 1985+ must be titled (canoes & small inflatables ≤ 25 HP exempt).

- Outboard Motors → 1985+ with >25 HP must be titled.

- Campers & Park Model RVs → 2015+ must be titled; older models optional.

- Roadable Aircraft → Require a title (must also be registered as aircraft).

- Novel / unusual vehicles → May require a title if registration is required.

Transferring a Title

- Use Utah’s Motor Vehicle Portal (MVP) for most transfers.

- Online transfers not allowed if:

- Record is suspended/pending info

- Vehicle is salvage/non-repairable

- Out-of-state title

Buying a Vehicle? Bring:

- Title or Bill of Sale from seller

- Safety & emissions certificates (if required)

- Taxes & fees (use Utah Fee Calculator online)

If the seller can’t find the title:

- Utah title → Seller completes Form TC-123 (Duplicate Title).

- Out-of-state title → Seller must request duplicate from that state; you can use bill of sale + temp permit meanwhile.

Replace Title

A title may be easily replaced online by requesting a duplicate title on our Motor Vehicle Portal (MVP).

Alternatively, you may send a completed Form TC-123, Application for Duplicate Utah Title and the $6.00 title fee to:

Motor Vehicle Division

Contact Center

P.O. Box 30412

Salt Lake City, UT 84130

Questions? Call Utah DMV: (801) 297-7780 or 1-800-368-8824.

Other Info

- Sales tax = based on purchase price (no family exemptions).

- Where’s my title? → Check online with Utah’s title status tool.

- Adding/removing names → Complete Form TC-656; fees apply.

- “And” vs “Or” on title → “And” = both owners must sign; “Or” = one owner can sign.

Utah License Plates

Standard Plates (Most Common)

- Current Options:

- Life Elevated (Skier or Arches)

- In God We Trust / United We Stand

- Off-Highway Vehicle (for ATVs, dirt bikes, etc.)

- Tip: You can personalize most of these with a custom message.

Special Group Plates (Cause- or Group-Specific)

- Support charities, schools, veterans, wildlife, and more.

- Examples: Autism Awareness, Cancer Research, University plates, Disabled plates, Firefighter, Veterans, Zion National Park.

- Requirements: Must qualify (e.g., military service, student/alumni, disability) and pay additional fees.

- Many can also be personalized.

Exempt Plates (Government Vehicles)

- Used on state, city, and public agency vehicles.

- Marked with “EX” for exempt.

- Includes Utah Highway Patrol and other government fleets.

No Longer Issued (But Still Valid)

- Old designs like Utah Centennial, Ski Utah, Olympic, Clean Fuel, and Vintage Vehicle.

- Tip: If you already have one, you can keep using it.

Visit the Utah DMV website or local DMV office to order, replace, or personalize your plate.

Bring proof of eligibility if applying for special group plates.

Replace Utah License Plate

Option 1 – Online (Fastest)

- Go to the Motor Vehicle Portal (MVP).

- Select Order Plate and follow the prompts.

- Pay the replacement fee (varies by plate type, starting at $12–$21.50).

- Includes new plate, decal, registration, and postage.

Option 2 – In Person

- Visit your local DMV office.

- Bring your latest registration, plate number, or VIN.

- Pay the replacement fee.

Option 3 – By Mail

- Write a replacement request.

- Include a copy of your registration certificate.

- Mail to:

Motor Vehicle Division Contact Center

P.O. Box 30412

Salt Lake City, UT 84130 - Pay with check or money order to “Utah State Tax Commission.” (No cash!)

Tip: If your plate was lost or stolen, act quickly to avoid fines or issues.

How can I do a Utah license plate lookup for free?

You can run a free Utah license plate lookup online to find basic details such as vehicle make, model, and year. Free databases may provide limited information, while paid services give a full history report. Always use reliable sources to ensure accurate results.

What information can I get from a Utah license plate search?

A Utah license plate search can reveal title status, accident history, mileage records, open recalls, and lien information. It may also show theft records and prior ownership details. This helps buyers verify if a vehicle is safe and legally clear to purchase.

Is it legal to run a Utah personalized license plate lookup?

Yes, Utah license plate lookups are legal as long as the information is used for permissible purposes under the Driver’s Privacy Protection Act (DPPA). Personal details like the registered owner’s address are restricted. You can still access important vehicle history without violating privacy laws.

Why should I use a Utah license plate lookup before buying a used car?

Running a Utah license plate lookup protects you from fraud and hidden problems. It helps confirm the car’s accident history, title status, and potential red flags. Buyers gain peace of mind knowing the vehicle is worth the investment.

Can I check if a Utah license plate is valid and registered?

Yes, a Utah license plate lookup can verify if a plate is valid and actively registered with the DMV. This prevents issues with fake or expired plates. It also ensures the vehicle has proper documentation before purchase or transfer.

Where can I perform a reliable Utah license plate lookup online?

You can perform a Utah license plate lookup through trusted sites like VinCheck.info or other vehicle history providers. The Utah DMV can also verify plate validity but may not provide full history reports. Choose a reputable source to access accurate and up-to-date information.